The United States is one of the largest aviation markets in the world. Therefore, it makes sense that the country is home to various airlines and has had a colorful airline history over the years.

However, despite the U.S. having such a large domestic market, one may argue that the country's aviation industry is an oligopoly. Could this be the case?

An "Oligopoly"?

Firstly, it would be helpful to define what an oligopoly is. An oligopoly is a market dominated by a small group of companies. This is often because multiple barriers exist to entry that are significant enough to discourage potential competitors.

Examples of such "barriers to entry" in the American airline industry include high airline startup costs, infrastructure constraints such as takeoff or landing slots, and the large economies of scale that various incumbents currently hold.

Four U.S. carriers combine for just over two-thirds of the domestic airline market share. As of February 2024, this amount was 68%. However, no single carrier's market share reaches 20% overall.

As of February 2024, Delta Air Lines controlled the domestic market share at 17.8% based on domestic revenue passenger miles over the previous 12 months. American Airlines and Southwest Airlines were close behind at 17.3% and 17.2%, respectively, while United Airlines came in fourth at 16%.

These four airlines have dominated the domestic American market for a very long time, making it challenging for other domestic airlines to grow their market share.

A prime example of this case was the proposed 2022 acquisition of Spirit Airlines by Frontier Airlines. This deal was worth $6.6 billion, and combining these two ultra-low-cost airlines would create the fifth-largest U.S. carrier. These two airlines combined for a domestic market share of 8.7%.

This acquisition was unsuccessful primarily because another U.S. carrier, JetBlue Airways, beat Frontier to secure a deal to acquire Spirit. Eventually, JetBlue was unsuccessful in its attempt to take over Spirit as the United States Department of Transportation ruled it counterproductive to antitrust law.

Domestic Airline Competition

The United States' Airline Deregulation Act became law in 1978. This act was intended to increase competition, and as more airlines entered the market, fare prices decreased in the 20 years that followed the act's passing.

Deregulation also led to more airline consolidation, propelling various mergers in the years that followed. Some notable ones in recent history include Delta and Northwest in 2008, United and Continental in 2010, Southwest and AirTran in 2011, and American and U.S. Airways in 2013.

You may notice a common denominator when analyzing these recent mergers. That is the fact that each one of those mergers includes an airline that now comprises the "Big Four" American carriers.

Various lawmakers have accused the American aviation industry of conspiring to influence anti-competitive practices. U.S. Senator Richard Blumenthal noted that "Consumers are paying sky-high fares and are trapped in an uncompetitive market with a history of collusive behavior."

Such concerns prompted a probe into the airline industry by the Justice Department in 2015. Eventually, there was no hard evidence found to propel a court case toward alleged anti-competitive practices.

Competition on some routes is limited and remains this way. Analysts primarily credit geography for this occurrence. Furthermore, demand and the size of airports contribute to this.

The three legacy airlines (American, Delta, and United) all operate or contract with regional carriers who fly regional jets to smaller communities across the country.

The American airline sector is considered to be an atypical oligopoly. While there is not one airline with a dominant market share, the four largest airlines provide services to the majority of passengers nationwide.

Hainan Airlines Takes Delivery of First A330-900neo » Delta to Launch Nonstop Flights to Riyadh, Saudi Arabia » Flying with Personality: The Hidden Story Behind Aircraft Registrations »

Comments (3)

Jeff

It sure would be a lot easier to read this article if it didn't have 10 ads between every paragraph, dozens of popups exploding all over the screen, and a loud video ad playing.

Jeff

It sure would be a lot easier to read this article if it didn't have 10 ads between every paragraph, dozens of popups exploding all over the screen, and a loud video ad playing.

Add Your Comment

SHARE

TAGS

INFORMATIONAL us airlineamerican airlinesoligopolyairline oligopolyunited airlinessouthwest airlinesus airline deregulationdelta airlinesRECENTLY PUBLISHED

The Next Big Upgrade in Air Travel Might Be Your Window Shade

While most cabin refurbishments focus on plush seats and mood lighting, one Florida company believes the next big upgrade lies in something passengers barely notice: the window shade.

STORIES

READ MORE »

The Next Big Upgrade in Air Travel Might Be Your Window Shade

While most cabin refurbishments focus on plush seats and mood lighting, one Florida company believes the next big upgrade lies in something passengers barely notice: the window shade.

STORIES

READ MORE »

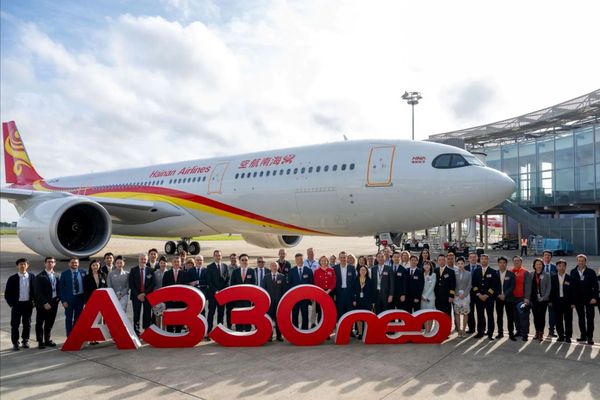

Hainan Airlines Takes Delivery of First A330-900neo

On October 31, Hainan Airlines received its first A330-900neo, marking the first delivery of this aircraft type to a Chinese carrier.

NEWS

READ MORE »

Hainan Airlines Takes Delivery of First A330-900neo

On October 31, Hainan Airlines received its first A330-900neo, marking the first delivery of this aircraft type to a Chinese carrier.

NEWS

READ MORE »

Flying with Personality: The Hidden Story Behind Aircraft Registrations

Just as one would name their car or boat, airlines sometimes give names to their aircraft. While many carriers choose names inspired by well-known cities, landmarks, or historical figures, one airline stands out by adding a unique twist, infused with a touch of classic British flair.

INFORMATIONAL

READ MORE »

Flying with Personality: The Hidden Story Behind Aircraft Registrations

Just as one would name their car or boat, airlines sometimes give names to their aircraft. While many carriers choose names inspired by well-known cities, landmarks, or historical figures, one airline stands out by adding a unique twist, infused with a touch of classic British flair.

INFORMATIONAL

READ MORE »