Airlines need insurance for their aircraft to deal with the potential consequences of operating flights. This includes damage to an aircraft due to an accident, extreme weather, or geopolitical events. The latter consequence has become more prominent in recent years due to various conflicts around the world. Two global conflicts airlines have been at the forefront of are the Russia-Ukraine war and the Sudan conflict.

The Russia-Ukraine Conflict

Russia's invasion of Ukraine in February 2022 led to major changes in the global aviation industry. The United States, the United Kingdom, and the European Union have placed an unprecedented amount of sanctions on Russia to punish the country for its actions. As a result of these sanctions, aircraft manufacturers such as Boeing and Airbus canceled their deals with Russian airlines and exited Russia entirely.

One requirement was that Russia return leased aircraft to their owners. However, Russian airlines ignored the request and re-registered the aircraft as Russian products. Hundreds of Western aircraft were stranded in Russia and are now used on other routes. This led to a legal battle between aircraft lessors and insurance companies over who should be responsible for the billions of dollars lost from the inability to retrieve these aircraft.

Almost a year-and-a-half after the war started, some companies are taking legal action against insurance companies that never paid outstanding insurance claims. As of July 7, more than 40 aviation leasing companies have joined the battle with insurance over who should be responsible for up to $10 million in costs from 400 aircraft stuck in Russia.

Lawsuits have been initiated across multiple countries including the United Kingdom. AerCap, the world's largest commercial aircraft owner, filed one of the most prominent lawsuits in June 2022. London's High Court plans to hear five cases brought by aircraft leasing companies next year over contingent insurance policies.

The scenario is different for reinsurance disputes, which reinsurers believe should be heard in Russia. This is because Russian airlines leased the aircraft from Western lessors and insured them through Russian insurers. The policies were later reinsured through global insurance companies such as AIG. The reinsurers want the claims to be heard in Russia due to jurisdiction clauses in the reinsurance policies. These clauses name Russian courts for any dispute.

However, holding court hearings in Russia is extremely difficult for a variety of reasons. The first reason is Russia's view of its Ukraine invasion as a "special military operation" instead of a war. This means that lessors will not receive coverage from war risk insurance, which covers losses due to war. Furthermore, sanctions have made it difficult for Westerners to travel to Russia, including the legal experts needed for the trial.

Western aircraft lessors want to avoid hearings in Russia due to the country's weak judicial system. According to court documents, the lessors said it would be impossible to achieve "substantial justice" in Russia. Lessors are instead turning to another form of negotiation: selling stranded aircraft to Russian airlines. Even though the lessors would lose billions of dollars, they view this as a more effective solution than dealing with the Russian legal system.

Russia is not the only country in which aviation companies have lost significant amounts of money. In April 2023, fighting between Sudan's army and the paramilitary Rapid Support Forces (RSF) led to aircraft destruction at Khartoum International Airport (KRT). The aircraft destroyed included a Boeing 737-800 from Ukraine's SkyUp Airlines and an Airbus A330-300 operated by Saudia.

Conflict in Sudan

Sudan's airspace is closed to regular traffic until July 31. The Sudan Civil Aviation Authority only allows flights that provide humanitarian aid or evacuate people from unsafe areas. Many countries have arranged charter flights to evacuate citizens from Sudan over the past few months.

Industry sources say the war in Sudan has already resulted in losses of between $240 and $300 million. Since losses in Sudan represent a significant amount of the aviation war insurance market, insurers are looking at doubling insurance premiums to compensate. The main players in this niche market include Lloyd's of London.

War insurance protects airlines against war-related incidents ranging from stolen aircraft to planes shot down from the sky. Aviation war insurance became more expensive in the early 2000s after 9/11 before decreasing for many years. Prices started increasing again in recent years after wars erupted in Sudan and Ukraine.

Some sources claim insurance rates could rise by up to 100% this year. Losses go to the reinsurance market since reinsurers ensure the insurers. This results in extra payments passed on to customers. Since the conflicts in Ukraine and Sudan do not seem likely to end anytime soon, premiums are expected to continue rising for the foreseeable future.

The Top 5 Longest Flights in the World » Top 5 Unique Gifts for Pilots & Aviation Lovers Under $50 » Game Day: The Unseen Operation Behind College Sports Travel »

Comments (0)

Add Your Comment

SHARE

TAGS

STORIES Russia-Ukraine Conflict Russia Ukraine Sudan Aviation InsuranceRECENTLY PUBLISHED

US Air Force to Launch New Experimental One-Way Attack Drone Unit

In a move that signals a tectonic shift in American airpower, the U.S. Air Force is preparing to stand up its first-ever experimental unit dedicated solely to "One-Way Attack" (OWA) drones.

NEWS

READ MORE »

US Air Force to Launch New Experimental One-Way Attack Drone Unit

In a move that signals a tectonic shift in American airpower, the U.S. Air Force is preparing to stand up its first-ever experimental unit dedicated solely to "One-Way Attack" (OWA) drones.

NEWS

READ MORE »

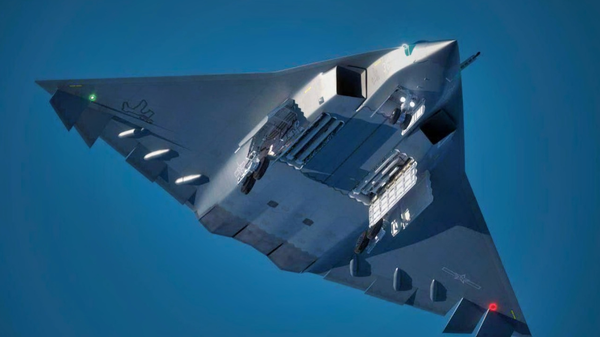

Pentagon Alarm: China’s ‘Tailless’ 6th-Gen Fighter Prototypes Are Already Airborne

The Pentagon’s annual 2025 China Military Power Report (CMPR), released this week, has sent a clear signal to Capitol Hill: the race for air dominance is no longer a one-horse race. For the first time, the U.S. Department of Defence has formally acknowledged the rapid progress of China’s sixth-generation fighter programs, highlighting the successful flight testing of multiple "novel tailless" stealth prototypes.

NEWS

READ MORE »

Pentagon Alarm: China’s ‘Tailless’ 6th-Gen Fighter Prototypes Are Already Airborne

The Pentagon’s annual 2025 China Military Power Report (CMPR), released this week, has sent a clear signal to Capitol Hill: the race for air dominance is no longer a one-horse race. For the first time, the U.S. Department of Defence has formally acknowledged the rapid progress of China’s sixth-generation fighter programs, highlighting the successful flight testing of multiple "novel tailless" stealth prototypes.

NEWS

READ MORE »

No "Mate's Rates" in the Sky as Qantas Bans All Staff (Including CEO) From New A350 First Class

In a move that signals just how "ultra" Qantas intends its new ultra-long-haul product to be, the Flying Kangaroo has made a rare and dramatic policy shift: barring all staff from its upcoming Airbus A350 First Class cabins.

NEWS

READ MORE »

No "Mate's Rates" in the Sky as Qantas Bans All Staff (Including CEO) From New A350 First Class

In a move that signals just how "ultra" Qantas intends its new ultra-long-haul product to be, the Flying Kangaroo has made a rare and dramatic policy shift: barring all staff from its upcoming Airbus A350 First Class cabins.

NEWS

READ MORE »